For US home builders, the current market is "challenging". In PR-speak, the word "challenging" means "total, unmitigated disaster".

Today, confidence among U.S. home builders crumbled this month to the lowest level in 16 years. The home builder sentiment index declined to 24 this month. We have to go back to January 1991 to find it at a lower reading.

Home builders certainly have plenty of problems out there to get them depressed. Inventories are high, sales are declining, prices are crashing, prospective buyer traffic is falling off and interest rates will stay at their current elevated level for months to come. Moreover, all those incentives, which have understated the true extent of the price crash,just aren't working anymore.

Things are so bad, it must be a challenge for US home builders to even get themselves out of bed in the morning.

Labels:

Almost a million foreclosures were filed during the first half of this year; a rise of 56 percent compared to the same period last year. Sub prime borrowers accounted for 58 percent of those foreclosures. This is only the beginning. In the coming months, a wave of adjustable rate mortgages will reset at significantly higher interest rates, and the foreclosure rate is going to explode. With this impending flood of foreclosures, the US housing market will seize up.

Where are the foreclosure epicentres? Nevada had the highest foreclosure rate in June. It had a shocking one filing for every 175 households, more than four times the national average of one per 704. Sunny California had the second-highest rate, with one filing per 315 households. It also took the price for the most filings overall - 38,801. In fact, the Golden state has taken that dubious title for sixth months in a row.

Colorado had the third-highest rate with one foreclosure per 317 households. Florida was fourth with one per 347, followed by Arizona with one per 383, Ohio with one per 403 and Michigan with one per 420.

When will it end? No time soon, that is for sure.

Labels:

In the face of overwhelming evidence of a housing market meltdown, the NAR is slowly recognising the extent of the disaster. Today, it published their latest market assessment, and further reduced their 2007 housing price forecast. The group now believe that house prices will fall by about 1.4 percent this year.

The NAR also reduced their sales forecast, suggesting that existing home sales will reach just 6.11 million this year. That is a lot of lost 6 percent commissions. Furthermore, the group now believes that housing starts in 2008 will fall to their lowest level since 1998.

Although the NAR have woken up to the the fact that 2007 will be a bleak year for realtors, denial again sets in when it considers 2008. The group believe that existing home sales will increase, and prices will recover slightly. Yeah right, 2008 will be prime time for ARM resets. The year will be marked by an avalanche of defaults and foreclosures, which will provide the ideal background for an market recovery.

A pattern is now emerging. From here on out, the NAR will produce their monthly forecast, with each press release more pessimistic than the one issued before. It will be a case of hope fighting it out with reality. Of course, reality always wins.

Labels:

The great thing about following the housing market is that however bad the news might be today, you know it will be worse tomorrow. The crap just keeps pouring on. Nothing can stop it.

Today, D.R. Horton - the second-largest U.S. homebuilder - supplied the misery. According to Bloomberg, the company will report a third-quarter loss after orders tanked 40 percent. Moreover, the company conceded that there is absolutely no sign of a housing rebound.

Orders dropped in every region, with the biggest declines in California, where the number of net sales orders fell 53 percent in California. The situation was also bad in the northeast, where orders tumbled 42 percent. More worrying for their long term viability, the average price for its houses slid 12 percent to $233,672.

With D.R. Horton the bad numbers just kept-a-coming. During the third quarter, the company accepted just 8,559 home orders, compared with 14,316 in the year earlier. The cancellation rate was a staggering 38 percent. The value of houses ordered took a hammering, plunging 47 percent to $2 billion.

Unsuprisingly, shareholders of D.R. Horton took fright and sold off the stock. This morning, the stock fell 58 cents, or 2.9 percent. Since the beginning of the year, the stock has dropped 25 percent. I wonder how bad the numbers will be next quarter?

That subprime mess just won't go away. It keeps coming back like an unwanted relative at Christmas. Today, S&P announced that it may cut the ratings on $12 billion of bonds collatoralized with subprime mortgages.

What will that do for all those hedge funds and securities firms stupid enougth to buy this toxic crap in the first place. Nothing good, that is for sure. Anyone holding anything even vaguely connected with the subprime market will be taking a one way trip to Loserville.

Labels:

Freddie Mac painted a desperate picture of the US housing market. According to its latest forecast, it expects that only 6.3 million homes will be sold this year; the lowest sales volume since 2001.

Residential lending will also tumble, Freddie expects the figure to drop to 2.75 trillion, the lowest since 2002. Meanwhile, it expects mortgage rates to spike at 6.7 percent this quarter; that is around 0.5 percent higher than the first three months of this year.

The big daddy of housing bubbles looks like it might be in some trouble. Over the last six months, there has been a surge in late mortgage payments. As we all know, today's late payment is tomorrow's foreclosure. The UK housing market is probably 18 months behind the market here in the US.

460,000 mortgage payments missed in the past six months as interest rates bite

Mortgage customers are feeling the pain as interest rates rise with more than 460,000 missing monthly payments in the past six months, new MoneyExpert.com research shows...

Around 77,000 mortgage payments are being missed every month, the independent financial comparison website says. And it fears the number could be set to rise as the Bank of England continues to pile on the pressure.

The results of similar research conducted by MoneyExpert.com in January this year revealed that homeowners were defaulting on their mortgage at a rate of around 36,000 a month throughout 2006. The company says the new figures suggest the rate of missed mortgage bills is close to doubling this year.

The Bank of England base rate has been increased by 1.25 per cent to the current 5.75 per cent since August 2006 with experts predicting that more rises could be on the way. Inevitably that has pushed up rates on tracker mortgages and standard variable rates as well as making it more expensive for people whose fixed rate deal has come to an end.

Council of Mortgage Lenders figures for the end of 2006 showed around 59,000 mortgages were three to six months in arrears.

Labels:

Why are the easiest lessons the hardest to accept. Take the relationship between money and inflation. Since the Romans, people have understood that if a government produces more money, prices rise. It is as simple as that.

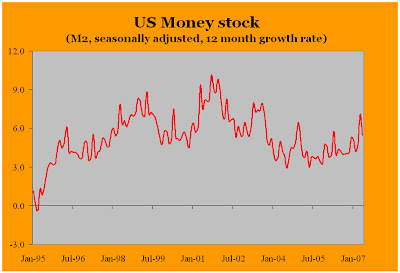

Does the Fed accept this most basic of economic relationships? The chart above tracks the 12 month rate rate of the most important measure of the money stock - M2. In 1995, the Fed did understand the importance of controlling the money supply. They had managed to get monetary growth down to around 1 percent a year.

Then something happened. Collectively, the FOMC must have taken a stupid pill. The committee ordered the guys in the basement to crank up the printing presses. In 1996, the money supply started to rise very rapidly indeed.

What were the consequences of all that extra money? The US got two speculative bubbles in a row. First,there was the stock market bubble, which reached a frenzy with the dot.com fiasco. The Fed calmed things down a little in 2000, raised rates and the dot.coms bombed. Undeterred, the Fed went at it a second time. In 2001, just after 9-11, the money supply began to increase, interest rates came down, and off went the housing bubble. Today, that mess is still being cleared up.

So, two speculative bubbles in ten years; with the dollar sinking to record lows. Few central banks have such a dismal record of incompetance. The federal government did their part. Encouraged by lower interest rates, it ran up a large fiscal deficit to complement the monetary chaos over at the Fed.

So, in macroeconomic terms, where is the US right now? It has a massive current account deficit; a large fiscal deficit; rising government indebtedness; personal debt is at an all time high; the economy is slowing, while the housing market has fallen down a dark hole; and to top it all, the Fed still has the money supply growing at around 6-7 percent annually.

What is the way out of this mess? Again, it is nothing complicated. The Fed must reduce the growth of the money supply, which means higher interest rates. This will encourage private sector savings, and reduce personal sector indebtedness. Higher interest rates will also discourage the federal government from running up large deficits. This recipe may involve some upfront costs - a recession is very likely. However, continuing this macroeconomic mess will only delay a much deeper and more painful economic downturn later.

Sadly, the Fed has still not quite understood the relationship. As the chart above indicates, monetary growth is still way too fast. Although, the housing market is unwinding; the Fed have ensured that there is still plenty of inflationary pressure building up. Sooner or later, rates will have to go up again.

Here is a neat clip looking at homebuilder stocks. Too much supply, overpriced inventory, and no demand; this all adds up to a bleak future for housing stocks.

8